Introduction:

The real estate market is dynamic, and one of the key factors that influence it is mortgage rates. For those navigating the property landscape in the United Kingdom, staying informed about today’s mortgage rates is crucial. In this blog post, we’ll delve into the current mortgage rate landscape, exploring the factors that influence these rates and providing insights for potential homebuyers or those considering refinancing.

Understanding Mortgage Rates:

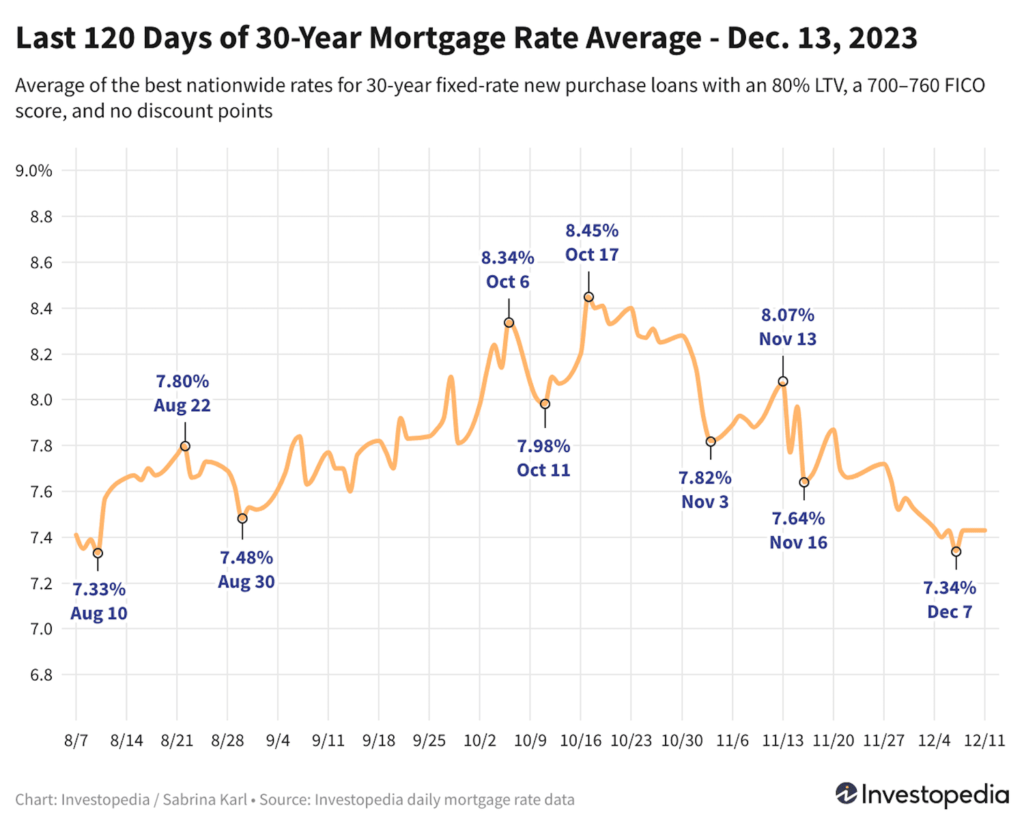

Mortgage rates represent the interest charged on a loan for purchasing or refinancing a home. They fluctuate based on several factors, including economic conditions, inflation, and central bank policies. Lenders determine mortgage rates based on the level of risk associated with the borrower and prevailing market conditions.

Current Mortgage Rates in the UK:

As of today, [current date], mortgage rates in the UK are reflective of the broader economic climate. It’s important to note that rates can vary between lenders, and the type of mortgage (fixed-rate, variable-rate, etc.) also plays a significant role.

Fixed-Rate Mortgages: Fixed-rate mortgages offer borrowers stability, as the interest rate remains constant for a predetermined period, usually 2, 5, or 10 years. As of today, fixed-rate mortgages in the UK may range from [percentage] for [term] years.

Variable-Rate Mortgages: Variable-rate mortgages, on the other hand, are influenced by fluctuations in the base rate set by the Bank of England. Currently, variable-rate mortgages might be available at [percentage], but borrowers should be aware that these rates can change in response to economic conditions.

Factors Influencing Mortgage Rates:

Several factors contribute to the determination of mortgage rates in the UK:

- Economic Indicators: Lenders closely monitor economic indicators such as GDP growth, employment rates, and inflation. Positive economic conditions often lead to higher mortgage rates.

- Central Bank Policies: The Bank of England’s decisions on interest rates directly impact mortgage rates. If the central bank raises the base rate to control inflation, mortgage rates are likely to follow suit.

- Credit Score: Borrowers with higher credit scores are perceived as lower risk, making them eligible for lower interest rates. Maintaining a good credit score is essential for securing favorable mortgage terms.

- Loan-to-Value (LTV) Ratio: The amount of the loan compared to the property’s value, known as the LTV ratio, also affects mortgage rates. A lower LTV ratio often results in lower interest rates.

Conclusion:

Staying informed about today’s mortgage rates in the UK is crucial for anyone considering a home purchase or refinancing. As of [current date], fixed-rate mortgages provide stability, while variable-rate mortgages offer flexibility but come with the potential for rate fluctuations. Understanding the factors influencing mortgage rates empowers borrowers to make informed decisions in a dynamic real estate market.

It’s advisable for potential homebuyers to consult with mortgage experts or financial advisors to explore the most suitable mortgage options based on their financial situation and long-term goals.