Contract rates and arrangements in the UK are continually evolving. That is the reason it’s essential to monitor current home loan rates and look at contracts prior to getting another arrangement. Whether you’re a first-time purchaser, moving home or remortgaging, NerdWallet can assist you with looking at the most recent home loan financing costs and find the best home loan bargain for you.

How to get the best mortgage rates and deals

Contract rates fluctuate contingent upon the sort of home loan you’re searching for, your monetary circumstance and your FICO assessment. Yet, when we discuss getting the best home loan rate, it’s essential to find the best rate among the home loan bargains that suit you and your conditions.

Contract charges and the elements you need in a home loan ought to constantly be viewed as close by the home loan rate while making contract correlations and looking for any home loan bargain.

Assuming that you’re in any capacity uncertain or need assistance finding the best home loan bargain for you we suggest you look for contract counsel.

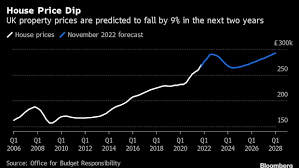

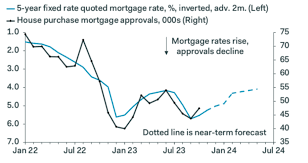

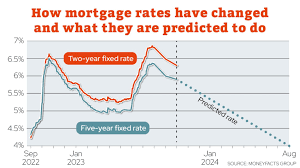

Are mortgage rates going down?

Contract rates have primarily been diminishing in the previous week. As of late probably the greatest banks, including Barclays, Cross country, Skipton Building Society, Virgin Cash and First Immediate, have brought down rates on a portion of their fixed-rate bargains. Different banks and building social orders have additionally decreased rates on chosen bargains.

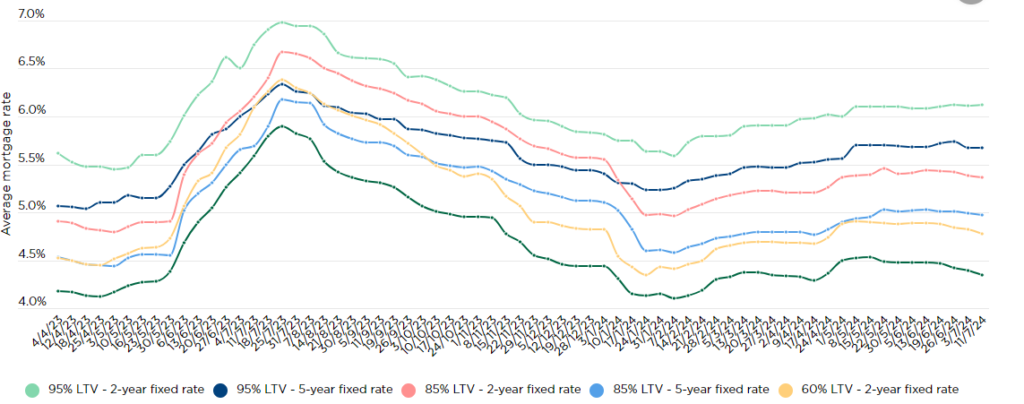

Accordingly, the typical expense of two-year fixed-rate contracts tumbled to 5.35%, down from 5.37% the prior week. The typical expense of five-year fixed rates dropped to 4.97%, from 4.98%.

The best home loan rate accessible among two-year fixed-rate contracts is 4.63%, while the least five-year bargain is estimated at 4.20%. The home loan rate information is accounted for week after week by Rightmove.

There was additionally some uplifting news for borrowers with contracts which will generally follow the base pace of revenue, as Virgin Cash and Clydesdale Bank both brought down their standard variable rates. While the base pace of revenue stayed on hold at 5.25% in June, the cuts recommend these loan specialists figure the rate could be going to fall.

Some have been foreseeing a decrease will be seen at the following rate-setting meeting on 1 August. Be that as it may, following remarks from two distinct policymakers lately, some figure the stand by might be somewhat longer, with September an expected choice all things considered. Vitally for borrowers, contract rates are anticipated to fall as a cut in the base rate moves nearer.

Average Fixed Mortgage Rates for Homebuyers

What are current UK mortgage rates?

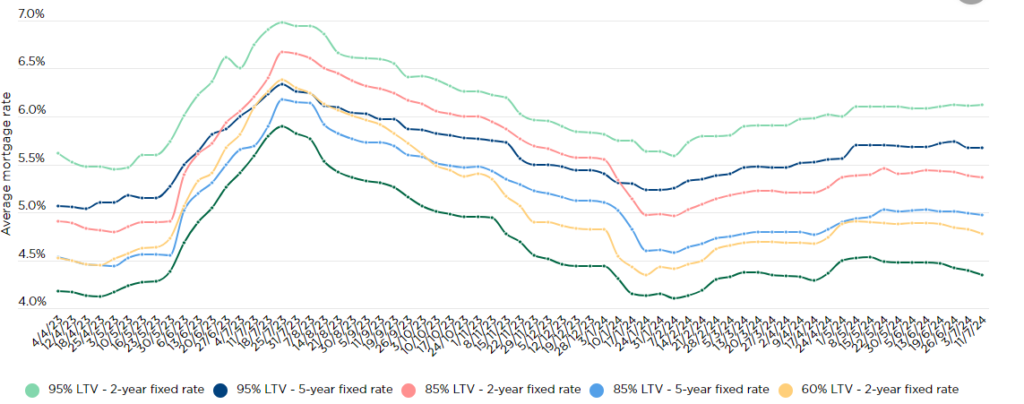

The typical pace of a two-year fixed-rate contract with a 25% store or value, tumbled to 5.18% over the course of the last week, down from 5.21%. On a comparable five-year fixed-rate bargain the typical rate dropped to 4.82% from 4.85%. On contracts which require a more modest store or value of 5%, the normal two-year fixed rate crawled higher to 6.12% from 6.11%, while the typical five-year rate was unaltered at 5.67%. All rates are as per Rightmove as at 11 July 2024.

Latest average two-year fixed-rate mortgage rates

| Loan to value (LTV) | 4 July 2024 | 11 July 2024 | Week-on-week change |

| 60% LTV | 4.81% | 4.78% | -0.03% |

| 75% LTV | 5.21% | 5.18% | -0.03% |

| 85% LTV | 5.38% | 5.36% | -0.02% |

| 90% LTV | 5.65% | 5.63% | -0.02% |

| 95% LTV | 6.11% | 6.12% | +0.01% |

Normal rates depend on 95% of the home loan market and items with an expense of around £999.

How home loan rates work

Contract rates are the loan cost you pay to a moneylender on the home loan balance you have extraordinary. The lower your home loan rate, the lower your month to month contract reimbursements will quite often be, as well as the other way around.

Various kinds of home loan

The kind of home loan you take out can influence the home loan rate you pay, and whether it might change going ahead.

Fixed-rate contract

A fixed-rate contract ensures that your home loan rate, and thusly your month to month reimbursements, won’t change during the set fixed-rate time frame that you pick.

This can assist with planning and means you are safeguarded against an ascent in contract costs on the off chance that loan fees start to increment. Notwithstanding, you’ll pass up a great opportunity in the event that loan fees begin to fall while you are gotten into a fixed-rate contract.

Variable rate contracts

With a variable rate contract, your home loan rate can possibly increase and fall and take your month to month reimbursements with it. This might benefit you assuming loan costs decline, however implies you’ll pay more on the off chance that rates increment. Variable rate home loans can appear as:

a tracker contract, where the home loan rate you pay is commonly set at a particular edge over the Bank of Britain base rate, and will consequently change in accordance with developments in the base rate.

a standard variable rate, or SVR, which is a rate set by your loan specialist that you’ll naturally continue on toward once an underlying rate period, for example, that on a fixed-rate contract, reaches a conclusion. SVRs will generally be higher than the home loan rates on different home loans, which is the reason many individuals look to remortgage to another arrangement when a fixed-rate contract closes.

a markdown contract, where the rate you pay tracks a bank’s SVR at a limited rate for a decent period.

Counterbalance contracts

With an offset contract, your investment funds are ‘balanced’ against your home loan add up to diminish the premium you pay. You can in any case get to your reserve funds, however will not get interest on them. Counterbalance contracts are accessible on either a fixed or variable rate premise.

Interest-just home loans

An interest-just home loan permits you to make reimbursements that cover the interest you’re charged every month except won’t take care of any of your unique home loan credit sum. This assists with keeping month to month reimbursements low yet in addition expects that you have a reimbursement technique set up to take care of the full credit sum when your home loan term closes. Premium no one but home loans can be set up on either a fixed or variable rate.

» MORE: Would it be a good idea for me to get an interest-in particular or reimbursement contract?

What rate changes could mean for your home loan installments

Contingent upon the sort of home loan you have, changes in contract rates can possibly influence month to month contract reimbursements in various ways.

Fixed-rate contract

Assuming you’re inside your fixed-rate period, your month to month reimbursements will continue as before until that closures, paying little mind to what’s going on to by and large financing costs. It is just once the decent term lapses that your reimbursements could change, either on the grounds that you’ve continued on toward your loan specialist’s SVR, which is generally higher, or on the grounds that you’ve remortgaged to another arrangement, possibly at an alternate rate.

Tracker contract

With a tracker contract, your month to month reimbursements typically fall in the event that the base rate falls, yet get more costly in the event that it rises. The change will typically mirror the full change in the base rate and happen naturally, yet may not in the event that you have a collar or a cap on your rate. A collar rate is one underneath which the rate you pay can’t fall, while a covered rate is one that your home loan rate can’t go above.

Standard variable rate contract

With a standard variable rate contract, your home loan installments could change every month, increasing or falling relying upon the rate. SVRs aren’t attached to the base rate similarly as a tracker contract, as loan specialists choose whether to change their SVR and by how much. Nonetheless, it is normally areas of strength for a that SVRs will generally follow, either to some degree or in full.

» MORE: How are fixed and variable rate contracts unique?

Contract Number crunchers

Messing with contract number crunchers is generally time all around spent. Get a gauge of how much your month to month contract reimbursements might be at various credit sums, contract rates and terms utilizing our home loan reimbursement mini-computer. Or on the other hand utilize our home loan revenue mini-computer to find out about how your month to month reimbursements could change assuming that home loan rates rise or fall.

Uk Mortgage Rates

FAQ: Mortgage Rates in the UK – July 2024

1. What are the current average mortgage rates in the UK for July 2024?

The average mortgage rates in the UK for July 2024 are as follows:

2-year fixed-rate mortgage: 4.50%

5-year fixed-rate mortgage: 4.20%

10-year fixed-rate mortgage: 4.30%

2. What factors are influencing mortgage rates in July 2024?

Several factors influence mortgage rates, including:

Bank of England base rate: Currently set at 4.75%.

Inflation: Higher inflation often leads to higher mortgage rates.

Economic conditions: Economic stability, employment rates, and GDP growth impact rates.

Housing market demand: Increased demand can push rates higher.

3. How do fixed-rate mortgages compare to variable-rate mortgages?

Fixed-rate mortgages: Provide a set interest rate for a specified period (e.g., 2, 5, or 10 years), offering stability in monthly payments.

Variable-rate mortgages: Interest rates can fluctuate based on the Bank of England base rate and other factors, leading to potential changes in monthly payments.

4. Are there any special mortgage deals available in July 2024?

Several lenders are offering special deals, including:

Discounted rates for first-time buyers.

Cashback offers.

Reduced arrangement fees.

5. What is the process for applying for a mortgage in the UK?

The typical process includes:

Assessing your finances: Determine how much you can afford.

Getting a mortgage agreement in principle: A lender’s indication of how much they might lend you.

Choosing a mortgage type: Fixed, variable, or other types.

Submitting an application: Provide financial documents, proof of identity, and other required information.

Receiving a mortgage offer: The lender’s formal offer, followed by legal and property checks.

6. How can I improve my chances of getting a good mortgage rate?

Improve your credit score: Pay off debts and avoid missed payments.

Save for a larger deposit: Larger deposits can lead to better rates.

Reduce existing debt: Lowering your debt-to-income ratio can be beneficial.

Shop around: Compare deals from different lenders and consider using a mortgage broker.

7. What fees should I be aware of when taking out a mortgage?

Common fees include:

Arrangement fee: The cost of setting up the mortgage.

Valuation fee: For assessing the property’s value.

Legal fees: Solicitor costs for handling the legal aspects.

Early repayment charges: If you repay the mortgage early within a fixed period.

8. Can I remortgage to get a better rate?

Yes, remortgaging can help you secure a better rate, especially if your current deal is ending or if your property’s value has increased.

9. What is a mortgage overpayment, and should I consider it?

A mortgage overpayment involves paying more than the required monthly payment. Benefits include:

Reducing the mortgage term.

Lowering the total interest paid. Check if your mortgage allows overpayments without penalties.

10. How are mortgage rates expected to change in the coming months?

While it’s challenging to predict precisely, rates are influenced by economic indicators, inflation, and Bank of England policies. Consulting a financial advisor or mortgage broker can provide more tailored insights.