Mortgage

Introduction

In the ever-evolving realm of personal finance, few decisions carry as much weight as that of refinancing a mortgage. With interest rates serving as the heartbeat of the housing market, borrowers constantly monitor fluctuations to seize the most favorable terms. As we step into 2024, the landscape of mortgage refinancing in the UK presents both challenges and opportunities for homeowners. In this guide, we’ll delve deep into the factors shaping refinance mortgage rates in the UK for 2024, empowering borrowers to make informed decisions about their financial futures.

Understanding the Current Market Trends

Before diving into the specifics of refinance mortgage rates, it’s crucial to grasp the broader context of the UK housing market in 2024. The economic landscape, influenced by factors such as inflation, employment rates, and governmental policies, sets the stage for interest rate movements. Following the aftermath of the COVID-19 pandemic and subsequent economic recovery efforts, the Bank of England’s Monetary Policy Committee (MPC) remains vigilant in balancing growth with inflationary pressures.

Factors Influencing Refinance Mortgage Rates

- Economic Indicators: Metrics like GDP growth, unemployment rates, and inflation levels serve as barometers for the health of the economy. Lenders closely monitor these indicators to anticipate shifts in demand for credit and adjust interest rates accordingly.

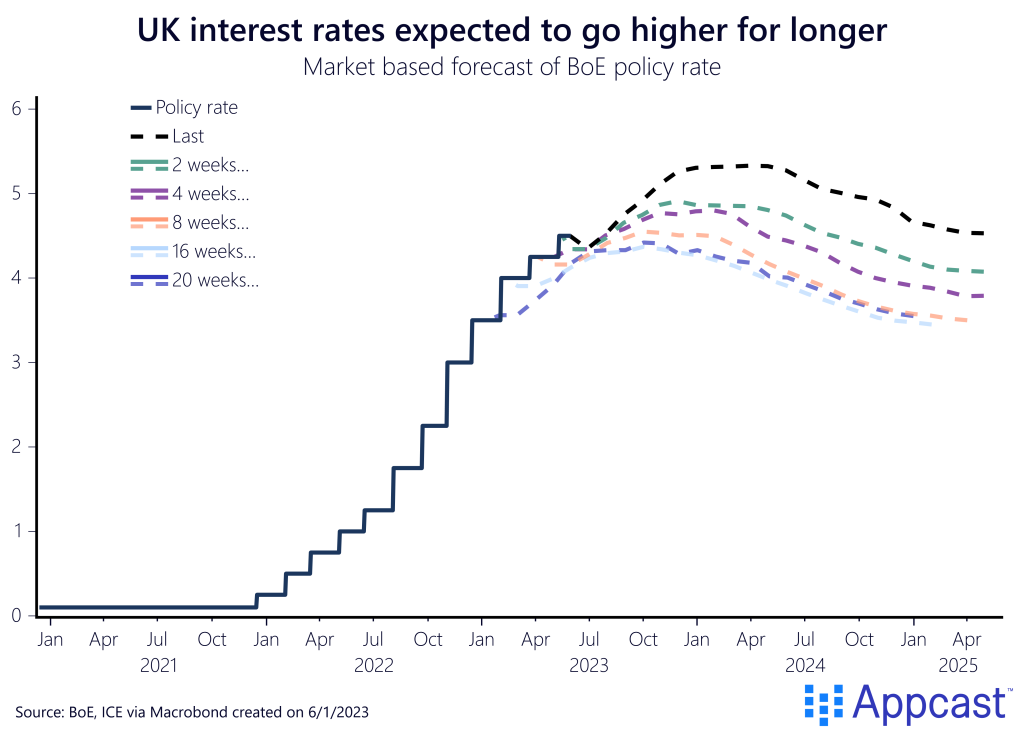

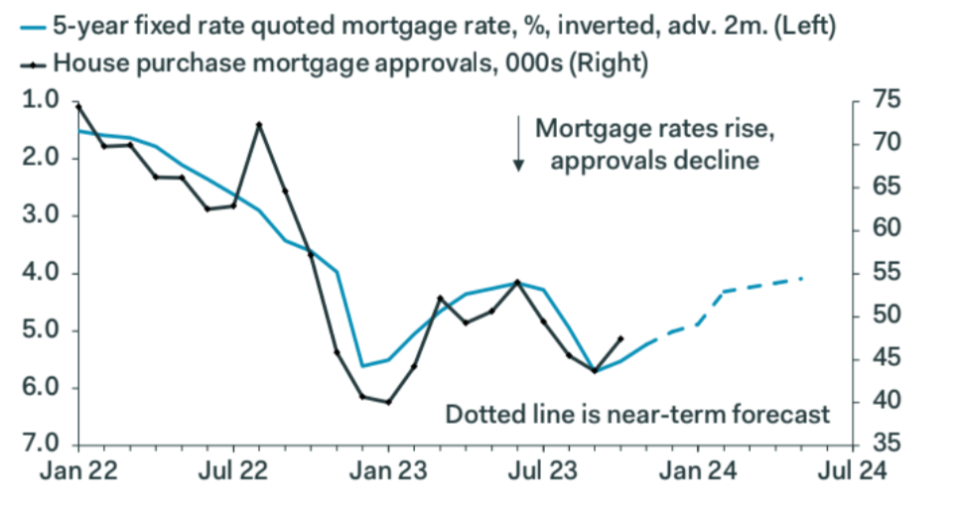

- Monetary Policy: The Bank of England plays a pivotal role in setting the base interest rate, which serves as a benchmark for mortgage lenders. Changes in monetary policy, driven by the MPC’s assessments of economic conditions, ripple through the housing market, impacting refinance mortgage rates.

- Global Economic Climate: In an interconnected world, events beyond the UK’s borders can influence domestic interest rates. Factors such as geopolitical tensions, trade agreements, and international monetary policies contribute to market volatility and shape refinancing opportunities.

- Lender Competition: The competitive landscape among mortgage lenders also influences refinance rates. As financial institutions vie for market share, borrowers may encounter varying offers and incentives, compelling them to shop around for the best deals.

Forecast for Refinance Mortgage Rates in 2024

While predicting future interest rates with absolute certainty is impossible, analysts and economists leverage available data and trends to offer insights into potential trajectories. In 2024, several factors are likely to influence refinance mortgage rates in the UK:

- Economic Recovery: With the UK economy continuing its rebound from the pandemic-induced downturn, the Bank of England may face pressure to gradually normalize monetary policy. As economic indicators strengthen, policymakers could signal a shift towards tightening, potentially leading to modest increases in interest rates.

- Inflation Dynamics: Persistent inflationary pressures, fueled by supply chain disruptions and rising energy costs, pose a dilemma for central banks worldwide. The Bank of England’s approach to managing inflation expectations will heavily influence its monetary policy decisions and, consequently, refinance mortgage rates.

- Global Uncertainties: Geopolitical tensions, trade disputes, and geopolitical tensions remain sources of uncertainty in the global economy. Any developments that disrupt financial markets or undermine investor confidence could prompt a flight to safety, impacting interest rates.

- Regulatory Changes: Regulatory reforms or interventions aimed at promoting financial stability and consumer protection could also affect mortgage lending practices and, by extension, refinance rates.

Strategies for Securing Favorable Refinance Terms

Given the dynamic nature of the mortgage market, borrowers can adopt several strategies to navigate the refinancing process effectively:

- Monitor Market Trends: Stay informed about economic indicators, central bank announcements, and global developments that could influence interest rates. Timing your refinance when rates are favorable can lead to significant savings over the life of the loan.

- Evaluate Personal Financial Situation: Assess your current financial standing, including credit score, debt-to-income ratio, and home equity. Strengthening your financial profile can improve your eligibility for competitive refinance offers.

- Shop Around: Explore offerings from multiple lenders to compare refinance rates, terms, and fees. Don’t hesitate to negotiate or leverage competing offers to secure the best possible deal.

- Consider Long-Term Implications: Look beyond the initial interest rate to evaluate the overall cost and benefits of refinancing. Factors such as loan duration, closing costs, and potential future rate adjustments should inform your decision-making process.

Conclusion

Refinancing a mortgage represents a significant financial decision that can have lasting implications for homeowners. As we navigate the uncertainties of the UK housing market in 2024, borrowers must stay vigilant, informed, and proactive in seizing opportunities to optimize their mortgage terms. By understanding the factors shaping refinance mortgage rates, monitoring market trends, and employing strategic approaches, homeowners can position themselves for financial stability and success in the years ahead.

In a landscape characterized by complexity and volatility, knowledge is the most potent tool in the borrower’s arsenal. Armed with insights from this comprehensive guide, individuals can embark on their refinancing journey with confidence, empowered to make informed choices that align with their long-term financial goals.

Other Mortgage Category

| Mortgage Interest Rates in the UK for 2024 | Mortgage in Principle in the UK |

| The Top Mortgage Lenders in the UK | Mortgage Pre-Approval in the UK |

FAQs: Refinance Mortgage Rates in the UK 2024

1. What are refinance mortgage rates?

Refinance mortgage rates refer to the interest rates charged by lenders when homeowners replace their existing mortgage with a new one. These rates determine the cost of borrowing and can vary based on economic conditions, lender policies, and individual borrower factors.

2. How do refinance mortgage rates in the UK differ from other types of interest rates?

Refinance mortgage rates specifically apply to homeowners seeking to adjust the terms of their existing mortgage. While similar to initial mortgage rates, refinance rates may differ due to changes in market conditions, lender incentives, and the borrower’s financial profile.

3. What factors influence refinance mortgage rates in the UK for 2024?

Several factors influence refinance mortgage rates in the UK, including economic indicators such as GDP growth, inflation levels, and unemployment rates. Monetary policy decisions by the Bank of England, global economic trends, lender competition, and regulatory changes also play significant roles in shaping refinance rates.

4. How can I determine if refinancing is the right decision for me in 2024?

Deciding whether to refinance your mortgage depends on various factors, including your current interest rate, the remaining term of your loan, your financial goals, and prevailing market conditions. Calculating potential savings, considering closing costs, and evaluating the long-term impact on your finances can help you make an informed decision.

5. Will refinance mortgage rates in the UK likely rise or fall in 2024?

Predicting future interest rate movements with certainty is challenging, as they are influenced by numerous economic and geopolitical factors. While forecasts and expert analyses provide insights, borrowers should remain vigilant and monitor market trends to capitalize on favorable refinance opportunities.

6. How can I secure the best refinance mortgage rates in the UK for 2024?

To secure favorable refinance rates, borrowers can employ several strategies, including improving their credit score, comparing offers from multiple lenders, negotiating terms, and staying informed about market trends. Additionally, considering the overall cost and long-term implications of refinancing is essential in making an informed decision.

7. Are there any risks associated with refinancing my mortgage in 2024?

While refinancing can offer potential benefits such as lower monthly payments or reduced interest costs, it also entails certain risks. These may include incurring closing costs, extending the duration of your loan, and the possibility of future interest rate fluctuations. Assessing these risks and weighing them against potential benefits is crucial before proceeding with a refinance.

8. How can I stay updated on changes in refinance mortgage rates in the UK for 2024?

Staying informed about refinance mortgage rates involves monitoring economic indicators, central bank announcements, and industry news. Utilizing online resources, consulting with financial advisors, and maintaining regular communication with lenders can help borrowers stay abreast of market developments and make timely decisions regarding refinancing.