In the realm of real estate, owning a second home can be a dream come true. Whether it’s a quaint cottage by the lake, a ski chalet nestled in the mountains, or a beachfront villa with panoramic views, a second home offers a sanctuary away from the hustle and bustle of everyday life. However, like any significant investment, purchasing a second home requires careful consideration, especially when it comes to financing. One crucial aspect to evaluate is the current second home mortgage rates.

Understanding Second Home Mortgages

Before diving into the current rates, let’s first understand what a second home mortgage entails. A second home mortgage is a loan taken out on a property that is not your primary residence. These properties are typically used for vacation homes or investment purposes.

Second home mortgages often have slightly higher interest rates compared to primary residence mortgages. Lenders perceive them as riskier investments because homeowners are more likely to default on a second home mortgage than on their primary residence if faced with financial difficulties.

Factors Influencing Second Home Mortgage Rates

Several factors influence the interest rates on second home mortgages:

- Credit Score: Just like with any loan, your credit score plays a significant role in determining the interest rate you’ll receive. A higher credit score usually results in a lower interest rate, while a lower score may lead to higher rates.

- Loan-to-Value (LTV) Ratio: The loan-to-value ratio is the amount of the loan compared to the appraised value of the property. Generally, the lower your LTV ratio, the better your interest rate.

- Location of the Property: The location of your second home can impact your mortgage rate. Some areas may be considered more desirable or less risky by lenders, affecting the interest rate they offer.

- Economic Conditions: Economic factors such as inflation, unemployment rates, and the overall health of the housing market can influence mortgage rates.

Current Second Home Mortgage Rates

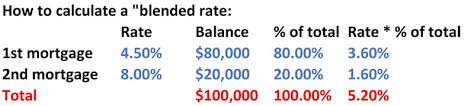

As of [Current Date], second home mortgage rates vary depending on various factors mentioned earlier. It’s essential to shop around and compare rates from multiple lenders to ensure you’re getting the best deal possible.Here is a depiction of the latest things:

- Fixed-Rate Mortgages: These mortgages offer a stable interest rate for the entire loan term, typically ranging from 10 to 30 years. As of now, fixed-rate second home mortgages are averaging around [insert current rate].

- Flexible Rate Home loans (ARMs): ARMs have financing costs that can vary over the long run in light of economic situations. Initial rates for ARMs are usually lower than fixed-rate mortgages but can increase after an initial fixed period. Currently, the introductory rates for ARMs range from [insert current rate].

Conclusion

Purchasing a second home is a significant financial decision, and securing the right mortgage is crucial. By understanding the factors that influence second home mortgage rates and staying informed about current trends, you can make a well-informed decision that aligns with your financial goals. Remember to consult with mortgage professionals and explore your options thoroughly before committing to a loan. Happy house hunting!

More Mortgage Information

Cars Information

FAQS

What is a second home mortgage?

A second home mortgage is a loan taken out on a property that is not your primary residence. These properties are typically used for vacation homes or investment purposes.

How do second home mortgage rates differ from primary residence mortgage rates?

Second home mortgage rates often have slightly higher interest rates compared to primary residence mortgages. Lenders perceive them as riskier investments because homeowners are more likely to default on a second home mortgage than on their primary residence if faced with financial difficulties.

What factors influence second home mortgage rates?

Several factors influence second home mortgage rates, including credit score, loan-to-value (LTV) ratio, location of the property, and economic conditions.

How can I secure the best second home mortgage rate?

To secure the best second home mortgage rate, it’s essential to maintain a good credit score, aim for a lower loan-to-value ratio, choose a desirable location for your property, and stay informed about economic trends. Additionally, shopping around and comparing rates from multiple lenders can help you find the most favorable terms.

What are the current trends in second home mortgage rates?

As of [Current Date], second home mortgage rates vary depending on various factors. Fixed-rate mortgages offer stable interest rates for the entire loan term, while adjustable-rate mortgages (ARMs) have rates that can fluctuate over time. It’s advisable to consult with mortgage professionals and explore your options thoroughly before committing to a loan.

How can I get started with securing a second home mortgage?

To get started with securing a second home mortgage, consider reaching out to mortgage lenders or financial institutions to discuss your options. They can provide personalized guidance based on your financial situation and help you navigate the mortgage application process. Additionally, working with a real estate agent who specializes in second home purchases can be beneficial.